Learn all about Coinbot features

Almost every Coinbot feature gets built based on community feedback. Together we make Coinbot more awesome every day.

Jump to:

Multi platform

Supported platforms and system requirements

Coinbot runs from your own Windows, macOS, Linux or ARM computer.

The software license is not tied to a specific device. Software updates and upgrades are free.

Recommended specs:

- 2GB RAM

- 10GB free disk space

- 64-bit CPU

You can choose between using the built-in graphical user interface or running Coinbot as a command line tool.

Major exchange support

Supported exchanges

Coinbot can trade on a number of different exchanges and offers almost the same functionality on all of them. New exchanges are regularly added.

Coinbot can trade on multiple exchange simultaneously.

NEW: all 100+ spot trading exchanges from the ccxt library are now supported.

| Exchange | Spot trading | Margin trading |

|---|---|---|

| Binance | ||

| Binance US | ||

| Bittrex | ||

| Bitfinex | With TradingView alerts | |

| Bithumb | ||

| Bitmex | ||

| Bitmex Testnet | ||

| Bitstamp | ||

| Cex | ||

| Coinex | ||

| Coinbase Pro | ||

| HitBTC | ||

| Huobi Global | With TradingView alerts | |

| Kraken | With TradingView alerts | |

| Kraken Futures | ||

| KuCoin | ||

| OKCoin | ||

| OKEx | ||

| Poloniex | With TradingView alerts | |

| Other supported exchanges |

No limits

Unlimited trading pairs

There are no restrictions to the number of active trading pairs in a Coinbot installation, this applies to every Coinbot edition.

Feel free to run just one trading pair, or even every pair available at your exchange.

In general, every pair offered by exchanges can be used with Coinbot.

Easy to use

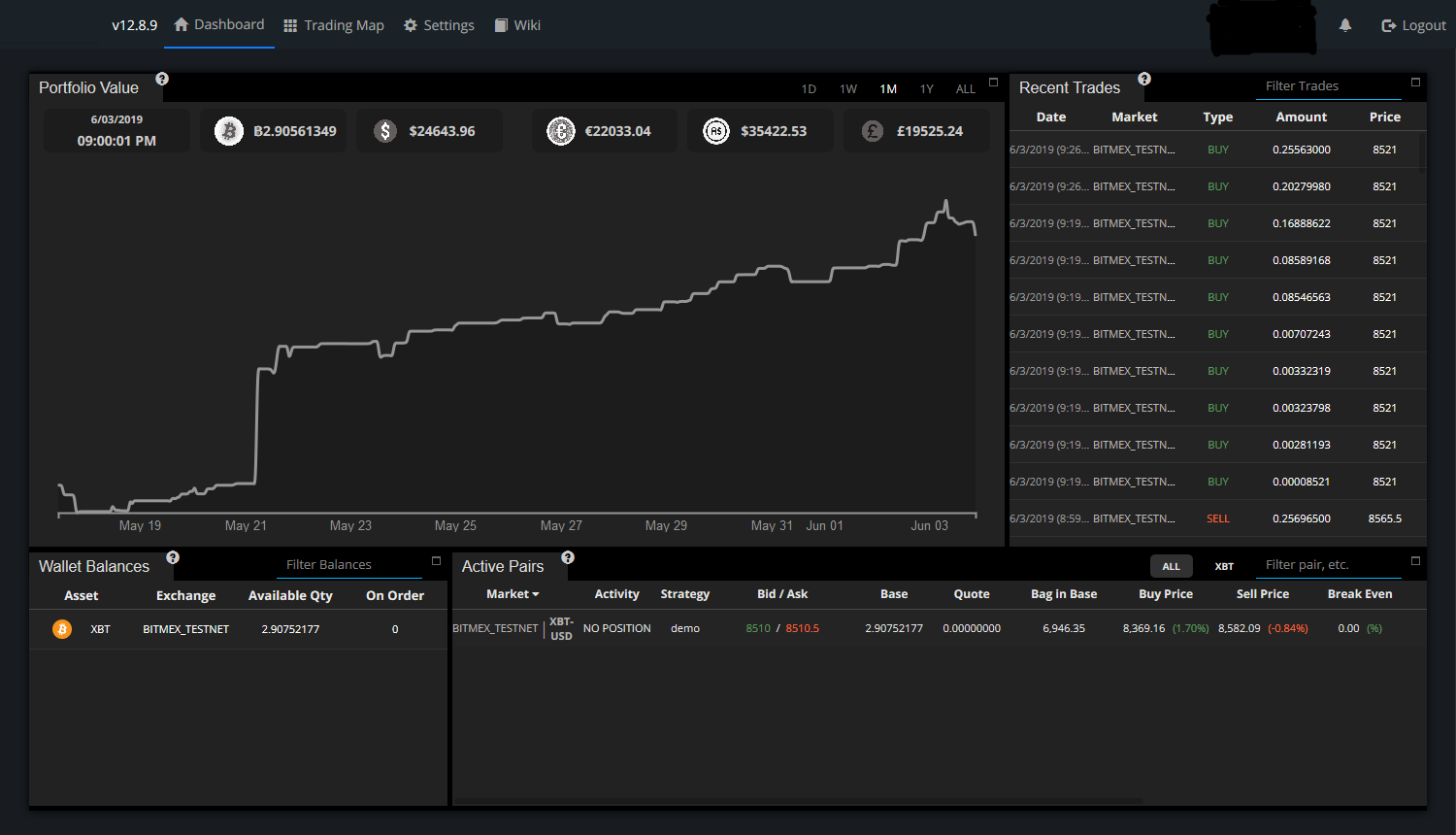

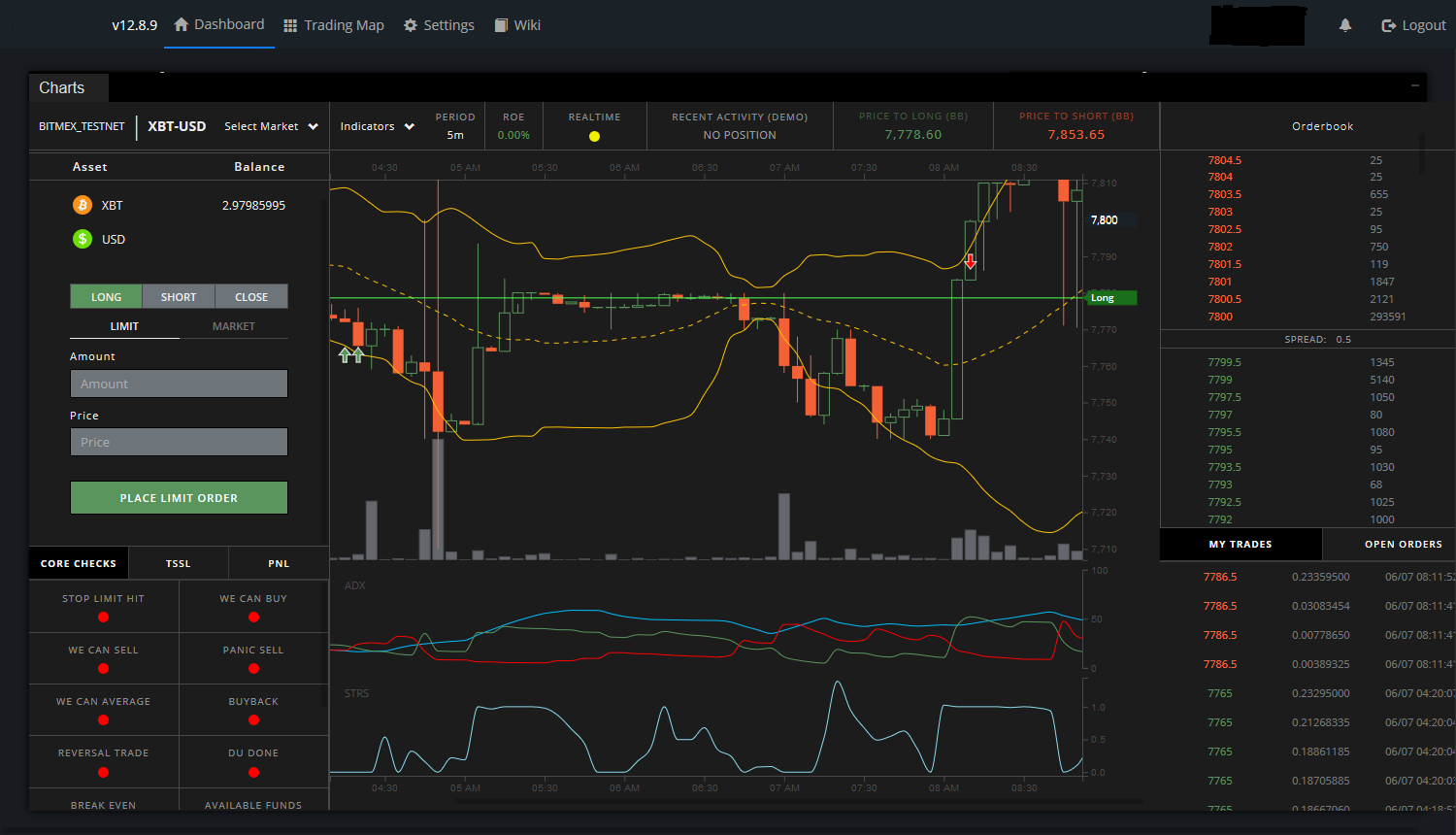

Powerful browser interface

Coinbot comes with a built-in browser interface. You can safely access the interface on your local machine, or open up access from the internet. The interface is optimized for mobile devices, supports two factor authentication and can be served via https.

Using the interface, you can easily manage your trading strategies, assign them to trading pairs and make changes on the fly. The dashboard shows all recent trades and wallet balances.

Additionally you can view detailed charts built with the data Coinbot collects from the exchange, trades are shown in these charts. This visualization of your trades makes it easy to optimize your trading strategies.

In case you don’t want to wait for the bot to place an order, you can place manual orders directly in the Coinbot interface. This also allows for manually averaging down, as Coinbot works with the average price paid for assets – regardless if Coinbot placed an order of you did so manually.

Tested presets or unlimited custom strategies

Tested trading strategies

A strategy in Coinbot is a set of rules that define how it trades. Every trading pair can be assigned a single strategy. Different pairs can use different trading strategies.

The main components of a strategy are buy and sell methods, which define when the bot is allowed to place orders. Strategies can be assigned to one or more trading pairs.

Coinbot comes with many free strategy presets, these are ready to use after making minimal changes - like configuring how much it is allowed to spend. You can create an unlimited number of custom strategies.

Coinbot comes with specially adapted strategies for margin trading, you can choose between mean reversion or trend following variants of individual strategies. With ROE trailing you can maximize profit from any position.

Every strategy can use a number of protections, like setting custom gain and stop limit values, limiting the number of sell orders before trading is halted, prevent buy orders above the last sell rate to protect against buying in surging markets.

Community developed

Buy & sell methods

Coinbot offers 15 different methods for executing orders. All methods can be freely combined in a custom strategy, for example you can setup Coinbot to purchase an asset at a percentage from the lower Bollinger Band, and sell that asset with a trailing stop / stop loss method.

Methods are the main trigger for an order. Additionally you can use a set of confirming indicators to specify the conditions you want to allow trading for. Every method can use a configurable stop limit to reduce your risk exposure.

A wide range of candlestick periods can be used. Select methods allow for pyramid buying.

| Method | Description |

|---|---|

| Average Directional Index (ADX) | Define a minimum ADX level that needs to be reached before trading. |

| Average True Range (ATR) Trailing Stop | A method using the ATR indicator to provide a configurable trailing stop. |

| Bollinger Bands - percentage distance from bands | Trade when price reaches a configurable percentage from the lower or upper Bollinger Bands. |

| Bollinger Bands - crossover (BBTA) Included with Coinbot Starter. |

Trade when price crosses over a configurable percentage from the lower or upper Bollinger Bands, after first moving outside of it. |

| EMA spread | Trade when the spread between slow and fast EMA increases / decreases. The minimum required spread is configurable. |

| Emotionless Included with Coinbot Starter. |

"Just works" method, hardy any configurable parameters. Perfect for novice traders. |

| Gain Included with Coinbot Starter. |

Buy at a configurable percentage below EMA, sell when a set percentage above the break-even point is reached. |

| Ichimoku | Trade on crossings of Kijun Sen and Tenkan Sen. The cloud (Kumo) can be used as optional confirmation. |

| MACD | Trade on crossing of the MACD line and the signal line. |

| MACDH | Trade on crossing of the MACD-Histogram and the zero line. |

| Pingpong | Buy and sell at exact configured prices. |

| Stepgain | Using a built-in trend watcher, trade when a downtrend turns into an uptrend and vice versa. |

| SMA cross | Trade on crossings of the slow and fast simple moving averages. |

| Time series analysis | Attempts to predict the next period close price, trades when the forecast is higher/lower than the current price. |

| Trailing stop / stop limit (TSSL) | Using configurable trailing ranges for buying and selling, prices are trailed for optimal entry and exit points. Orders are placed when the trailing stop is hit. |

Industry standard indicators

Confirming indicators

To refine your trading strategy, you can configure confirming indicators which restrict your buy/sell method to trading only when certain indicators are within a range you configure.

For example: only allow buy orders when RSI is 30 or lower. The period settings for every indicator are fully configurable.

Available confirming indicators, natively available in strategies:

- ADX

- EMA

- EMA spread

- MFI

- RSI

- Stochastic

- StochRSI

- Optional: configure custom indicator combinations using any of the indicators in the Tulip library.

Get the best out of your trades

Additional trailing

Additional price trailing can be used for most types of orders, to reach optimal entry- or exit points.

For example: you have set up a buy method based on buying when prices reach the lower Bollinger band. Without additional trailing a buy order is placed as soon as price hits the lower band. With trailing, Coinbot follows prices as they move down even further, and only buy once the trailing stop is hit while price is still at or below the lower Bollinger Band.

You can also use Coinbot for sell trailing for assets you bought manually.

Types of orders that allow for additional trailing:

- Regular buy orders

- Regular sell orders

- DCA buy orders

- Reversal trading buy orders

- Reversal trading sell orders

- Margin trading close orders

Next level Telegram bot

Telegram integration: CryptoSight

Interact with your trading bot through Telegram

Track profits

Get profit/loss statistics for all your trading pairs.

Get notified

Get push notifications for every executed trade.

Modify settings

Quickly change settings on the go, like enabling or disabling pairs.

Monitor trades

Easily get an overview of recent trades, you can even filter by pair.

Bust your bags

Dollar cost averaging (DCA)

Double up is a Coinbot method for automatically averaging down assets, also called dollar cost averaging or DCA.

This allows you to reach a lower average price per unit when prices move down, making for a lower possible profitable exit price.

The behavior of DCA is highly configurable. You can set the following options:

- The trigger for DCA orders: choose from (a combination of) a percentage price drop, RSI range or price crossing down the upper Bollinger Band.

- The minimum price difference between buy orders while in DCA.

- The number of times DCA orders are placed.

- The amount, as a ratio compared to the amount of quote units already owned, to be bought with every DCA order.

Accumulate

Reversal trading

Coinbot can automatically accumulate quote currency when prices move down, without investing more than the initial buy order. This feature is called reversal trading and can help bring down the break-even point for your investment.

With reversal trading, Coinbot will sell quote units owned at a configurable percentage price drop, then buy back more quote units using only the funds acquired from the previous sell order. This process can keep repeating while prices move down further, or even when the market goes sideways after an initial drop.

While accumulating, Coinbot keeps track of the trading fees paid during the process. As soon price hits the break-even point, it will continue with regular trading.:

Fine grained control

Balance options

You can set per pair limits for the amount of base currency to invest per trade. The trading limit can be set as an absolute amount, or as a percentage of available base currency.

When selling, you can choose to sell all quote currency, or keep a number of quote units. Coinbot can be set to ignore “dust”: small holdings below the minimum trade size of the exchange.

A funds reserve feature is available to keep an absolute amount of base currency reserved at all times. Optionally, you can automatically withdraw profits made in BTC.

Test test test

Backtesting add-on

The backtesting add-on allows for backtesting of almost all strategy parameters available in Coinbot. It can also be used to send alerts based on Coinbot strategies, to be executed by Coinbot with the TradingView add-on

Backtesting takes place on tradingview.com, which offers a powerful engine to backtest and visualize tested trading performance. As long as tradingview.com supports the exchange you trade on, historical data for backtesting is available for almost every available coin pair at the exchange.

Coinbot strategies are emulated on tradingview.com, with the exception of a few methods that cannot be replicated (like the time series analysis method).

Use custom scripts

TradingView add-on

The TradingView add-on makes Coinbot execute trading alerts sent from tradingview.com.

This allows for fully custom strategies, using pine script at TradingView. The add-on allows for a few protections, like making sure sell orders happen above the break-even point and meet the exchange minimum trade volume.

The add-on can be used in a mixed mode too, where both a Coinbot strategy is executed and TradingView alerts are being executed.

Insane automation

AutoConfig

Manage your bot automatically with AutoConfig

AutoConfig is a suite of tools you can use to dynamically manage your Coinbot configuration. Do you want to trade only the top10 pairs by 24h trading volume? AutoConfig can fully automate that, and a lot more advanced pair filters are available too.

Almost every aspect of the configuration can be automated with filter rules you define yourself. This even allows for automating strategy aspects, for example trade with a dynamic gain target. You can even monitor conditions on one pair and change settings on another.